Reviewed by: Jo-El Gonzalez

If you’re finding it hard to save money, you’re not alone.

Surveys show that over 56% of Americans have fewer than $1,000(opens in new tab) in their savings accounts, leaving many to risk going into debt just to cover a single emergency expense. Looking into the future, over 20% of Americans have less than $5,000 in retirement savings.(opens in new tab) These are alarming statistics that, if not corrected, could have repercussions that last for years.

In fairness, there are outside factors that make it difficult to save money. Insufficient income, job loss or economic factors like inflation can unravel the financial plans of even the most staunch penny-pincher. Yet it’s also important to realize that many of the savings obstacles we face are avoidable if we recognize the challenges and commit to changing our habits.

People naturally prioritize current wants over future needs-- and that’s one of the reasons why saving money for the long term seems so difficult. Psychological studies have shown that we have a hard time identifying with our future selves(opens in new tab); in many ways it almost feels like a different person as the rush of instant gratification battles with our reasoning and logic.

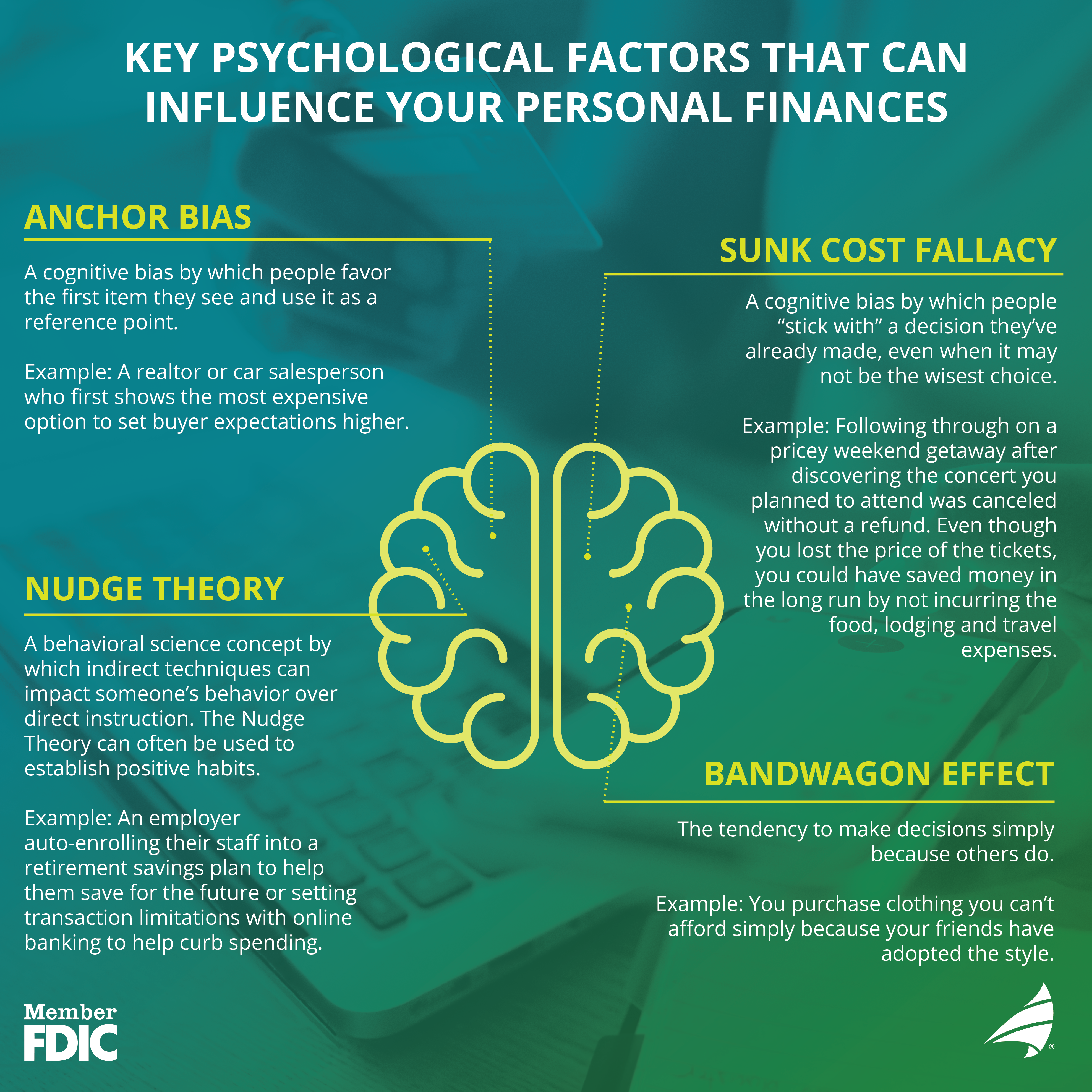

As it turns out, other cognitive biases and psychological traps are at play that can hinder our efforts.

Anchor Bias – With anchor bias(opens in new tab), people favor the first item (or person) they saw and use it as a reference point moving forward. In financial terms, anchor bias is commonly used as a sales tactic, such as a realtor who shows more expensive houses first to set buyer expectations higher or car dealerships placing higher-priced models at the center of the showroom floor. When it comes to saving money, it pays to do your research and consider all your options before moving forward.

The Bandwagon Effect -- The bandwagon effect(opens in new tab) states that people will adopt practices simply because others are doing it. We often see the bandwagon effect take control of our clothing, technology and music choices, causing us to overspend simply because our social circles are doing it. Being mindful of societal pressures and surrounding yourself with individuals who support your saving goals can positively impact your financial wellness.

Sunk Cost Fallacy – Many people believe that if we put effort into something, we should get something in return. While often true, that bias can be detrimental to our abilities to save money, according to sunk cost fallacy(opens in new tab). Let’s say, for example, you purchase a weekend stay at a hotel and it’s non-refundable. You later see that bad weather is going to ruin your experience, but you decide to stick it out “to get your money’s worth”. In this case, you’re spending money on a trip in the form of food, gas and experiences knowing you won’t enjoy it. How much money would you have saved if you’d cut your losses and not gone on the trip? Another example of sunk cost fallacy would be following through with a high-interest car loan simply because you’ve already made a deposit.

While these traits can challenge our ability to save money, there’s one bias that can support it.

Nudge Theory(opens in new tab) was popularized in a best-selling book by Nobel-winning economist Richard Thaler and legal scholar Cass Sunstein. In their book, Thaler and Sunstein describe a nudge as:

Any aspect of the choice architecture that alters people’s behavior in a predictable way without forbidding any options or significantly changing their economic incentives. To count as a mere nudge, the intervention must be easy and cheap to avoid. Nudges are not mandates. Putting the fruit at eye level counts as a nudge. Banning junk food does not.

Using their example, the action of placing healthy fruit options above junk food varieties may be enough to promote a positive action.

So how can the nudge theory help us save money? In a financial sense, a nudge would be making 401k account contributions default rather than opt-in, which increases participation(opens in new tab), setting up automatic transfers into to your savings account(opens in new tab) or creating transaction alerts within your online banking app(opens in new tab) to help curb overspending.

Another example of nudge theory would mean reframing how you think about saving money in the first place. Instead of a sacrifice or restriction, think of saving as an investment(opens in new tab) that leads to financial security and peace of mind.

Looks like a little nudge can go a long way. But what about our tendency to favor the present moment over future goals? For that, experts recommend(opens in new tab) celebrating small wins.

Behavior, whether positive or self-defeating, tends to reinforce itself(opens in new tab). Think about how the first few days of a diet or an exercise regimen are always the most difficult. Yet once you get the ball rolling, it becomes easier. This is largely because we feel better about ourselves as we undertake these projects and the progress we see reinforces our belief that the sacrifice is worth it. It’s important to break down your goals into smaller, manageable steps.

In terms of meeting your savings goals, setting and tracking small milestones often serves as the push we need to escape our tendency to procrastinate or rationalize. By making a few successful deposits into a savings account(opens in new tab), using money management tools within online and mobile banking(opens in new tab) or securing a better rate on an existing auto loan(opens in new tab) we begin a chain of positive self-reinforcing behavior. Ultimately this helps create the habits we need to realize life’s financial goals.

In terms of meeting your savings goals, setting and tracking small milestones often serves as the push we need to escape our tendency to procrastinate or rationalize. By making a few successful deposits into a savings account(opens in new tab), using money management tools within online and mobile banking(opens in new tab) or securing a better rate on an existing auto loan(opens in new tab) we begin a chain of positive self-reinforcing behavior. Ultimately this helps create the habits we need to realize life’s financial goals.

Cognitive biases and natural human tendencies can be a serious roadblock to achieving financial security. By acknowledging our biases and lessening their effects, you can develop better habits to get your savings on the right track and finally take control of your financial future.

Connect with your local Seacoast Bank branch(opens in new tab) associate for guidance on personal savings options and financial tools that can provide the nudge you need to get your finances on track.

Are you interested in contacting a local, Florida banker to discuss your individual financial needs? We’d love to speak with you. Schedule a consultation today.

Share: