A household financial plan serves as a roadmap for keeping your finances on track and growing your savings. It can help you set money goals, manage potential risks and build financial security. While budgeting is one component of a household financial plan, this type of roadmap focuses more on long-term financial planning.

A household financial plan serves as a roadmap for keeping your finances on track and growing your savings. It can help you set money goals, manage potential risks and build financial security. While budgeting is one component of a household financial plan, this type of roadmap focuses more on long-term financial planning.

If you’re interested in improving your money situation, here’s how to start building your plan.

Everyone has different financial goals, so it’s important to define yours before you begin. Doing so can provide insight into what you’d like to achieve, serving as a valuable framework for your financial plan. Examples of goals include, but aren’t limited to:

As you’re developing your goals, consider using the SMART framework to create a roadmap for achieving them. SMART stands for specific, measurable, achievable, relevant and time-bound. So, for example, rather than simply saying you want to save for a vacation, you could drill down further. This could mean saving $2,000 for a vacation over one year and committing to save $167 a month to meet your goal. This gives you a concrete framework for what you’d like to achieve.

Your family’s financial goals will be the foundation for your household financial plan.

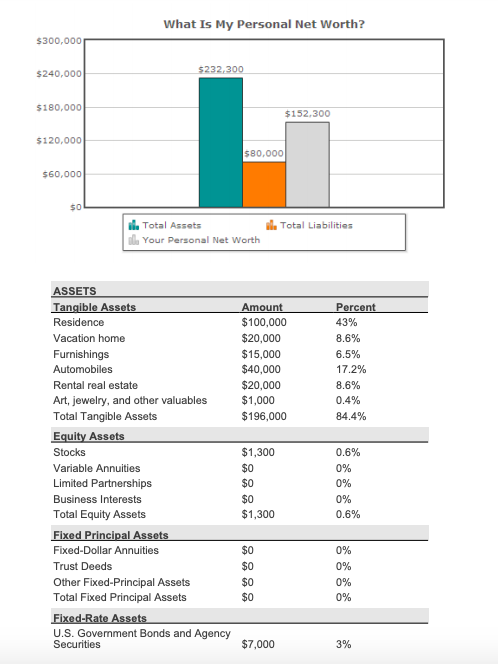

You’ll also want to consider your income, expenses and assets as you create your plan. Your income includes your monthly earnings, and your assets are existing savings like an emergency fund or investment account. Your expenses, sometimes called liabilities, are the amount you spend monthly on essential and discretionary costs.

Managing your finances doesn’t have to be complicated. With Seacoast Bank’s Budget Calculator, you can quickly get a clear picture of your income, expenses and overall financial health. The tool is designed to help you apply the 50/30/20 budgeting rule—allocating 50% of your income to needs, 30% to wants and 20% to savings or debt repayment. Just plug in your numbers, and the calculator does the rest, giving you a straightforward breakdown to help guide smarter financial decisions.

Other tools, like Seacoast’s online banking tools, let you review and analyze your spending history, categorize your transactions, track your cash and monitor your accounts. These tools can help you better manage your money.

A solid emergency fund strategy can help shield you from financial risks. Having money in an emergency fund can help you avoid breaking your monthly budget if the unexpected happens. It can protect you from unfortunate scenarios such as job loss, high medical bills or expensive and unplanned auto repairs.

Experts recommend setting aside 3-6 months' of emergency savings to cover essential costs like housing and food. But saving even more than that could provide more peace of mind, especially if a large expense crops up. The Seacoast savings calculator can help you test out different savings and budgeting strategies.

Building an emergency fund can be one of your short-term financial goals, and you can define how much you’d like to set aside and over what time period. For instance, you may decide you’d like to save $5,000 in 16 months by setting aside $313 per month.

Consider opening a separate Seacoast savings account for your emergency fund. That way, your money will remain accessible, but you won’t be tempted to use it for everyday costs.

Besides building an emergency fund to stave off risk, you’ll also want to ensure you have health, disability, life and home insurance. These coverages protect you and your family in different ways.

Besides building an emergency fund to stave off risk, you’ll also want to ensure you have health, disability, life and home insurance. These coverages protect you and your family in different ways.

Health insurance, for instance, can pay for a significant portion of your routine and non-routine medical bills, while disability insurance offers financial protection if you’re injured and need to stop working for a set period. Life insurance safeguards your family’s finances in the event of your death, and home insurance protects your house if a severe storm or a fallen tree limb damages it.

Insurance helps ensure that your household's financial plan stays on track if the unexpected happens. It’s an important safeguard for your money, family, health and home.

Saving and investing for retirement, education and other long-term goals should also be part of your household's financial plan. Typically, if you’re building your emergency savings, you’re setting funds aside in a regular savings account at a bank or credit union. That account might earn an annual percentage yield, but your balance won’t increase or decrease substantially unless you withdraw or deposit money.

Investing works differently. When you invest, you add funds to a retirement account or an education savings account, both of which let you invest in equities, bonds and other assets. Your balance could increase or decrease depending on how the market shifts in response to the broader economy, company performance and other factors.

It’s important to note that there’s always a risk of loss with investing, whether you’re putting money into an employer-sponsored 401(k), an individual retirement account (IRA) or a 529 for your child’s education. That said, the risk can be worth the reward, as investing remains one of the best ways to build wealth over the long term.

If you have questions about savings or investing, working with a financial or investment advisor could provide some valuable guidance. It could also help boost your confidence if you’re just getting started.

If there’s one constant in life, it’s change. It’s important to review or adjust your household financial plan regularly. This is especially true if you’ve experienced a big life change, such as getting married or divorced, having a child or starting a new job.

But it’s also smart to plan annual financial checkups, even if you don’t experience any major life changes. Your short or medium-term goals might change, and regular reviews and adjustments to your financial plan could help you reprioritize or set new goals. Or maybe you recently got a raise and need to adjust your monthly budget. Routine checkups can help ensure your plan stays as relevant as possible to your current financial situation.

A long-term financial plan can help you set financial goals, such as building an emergency fund or saving for retirement, and developing a concrete path to achieving those goals. Your financial plan can also protect you from risks, such as job loss or a work injury, and reviewing and adjusting it regularly can help you account for life changes, big and small.

Ready to build an emergency fund as part of your financial planning? Start your financial journey with confidence—open a Seacoast savings account or speak with a financial specialist today.

Are you interested in contacting a local, Florida banker to discuss your individual financial needs? We’d love to speak with you. Schedule a consultation today.

Share: