Market Volatility has the potential to erode your net worth. You can take steps now to help insulate your wealth against future market fluctuations.

It’s hard not to react when markets make sudden, large moves. Greed and fear are natural human emotions that, if given free rein, can lead investors to buy high and sell low. That can be a recipe for wealth destruction.

The time to handle market fluctuations is before they happen. Planning starts with an understanding of how your portfolio will react to volatility, and then making moves to restructure your wealth to fit your risk profile.

Diversifying your investments across a broad set of asset types is a central feature of your wealth planning. Knowing your tolerance to risk, stage of life, and need for liquidity should shape your asset allocation so that you can tolerate volatility without it triggering sudden, unplanned reactions.

When you work with a skilled wealth professional, you have access to planning tools that show how your portfolio might react to various market scenarios. Together, you and your financial professional can restructure your portfolio to match your risk profile. A properly structured portfolio will help you resist the knee-jerk impulse to do something when markets jump.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification and Asset Allocation do not protect against market risk.

Contact an advisor with Seacoast Bank today. We'll help you re-organize your assets to help provide confidence in periods of market volatility.

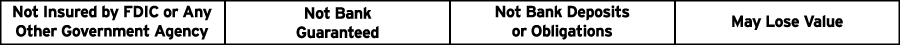

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products offered through LPL or its licensed affiliates. Seacoast Bank and Seacoast Investment Services are not registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using Seacoast Investment Services, and may also be employees of Seacoast Bank. These products and services are being offered through LPL or its affiliates, which are separate entities from,and not affiliates of Seacoast Bank or Seacoast Investment Services. Securities and insurance offered through LPL or its affiliates are:

The LPL Financial registered representatives associated with this website may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.

Topics: Invest & Retirement, Investment Strategies

Are you interested in contacting a local, Florida banker to discuss your individual financial needs? We’d love to speak with you. Schedule a consultation today.

Share: