There’s a simple word that has profound implications for savings and investing: compounding. Like a snowball that grows as it rolls down a hill, compounding provides the potential for your money to grow, reinvesting your investment earnings.

It is a basic model for growth potential, and the more you invest, the greater the opportunities to create long-term value. Let’s take a look at hypothetical examples1 to illustrate:

If you invest $1,000 at age 20 and do not add anything to the principal, relying instead on 7.2% annual earning growth, you would end up with $32,000 at age 70.

If you wait until you’re 30, though, investing that same $1,000 that earns 7.2% annually, you would end up with $16,000 at age 70 — a decrease of 50%.

Finally, if you invest the $1,000 at age 20, earning 7.2% annually while contributing $83 a month until retirement, you would have $465,000. (This is a hypothetical example and is not representative of any specific situation. Your results will vary. The hypothetical rates of return used do not reflect the deduction of fees and charges inherent to investing.)

To estimate how long it will take for compounding to double an investment, use the rule of 72:

Divide 72 by the annual rate of return. The answer is the approximate number of years it would take to double your investment’s value, assuming a fixed rate of return.

As an example: If you earn 9% annually, it will take 72/9 = 8 years to double the value of your investment.

Please note: the rule of 72 is a mathematical concept and does not guarantee investment results nor functions as a predictor of how an investment will perform. It is an approximation for the impact of a targeted rate of return. Investments are subject to fluctuating returns and there is no assurance that any investment will double in value.

Adopt a strategy to maintain your portfolio for the long-term, it can help you emotionally ride out the short-term effects of sharp market swings.

1 From https://www.hermoney.com/invest/retirement/these-two-examples-illustrate-the-magic-of-compound-interest/.

Check the background of our investment professionals on FINRA's BrokerCheck.

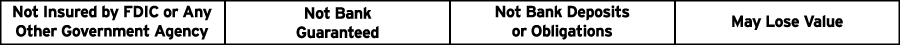

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products offered through LPL or its licensed affiliates. Seacoast Bank and Seacoast Investment Services are not registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using Seacoast Investment Services, and may also be employees of Seacoast Bank. These products and services are being offered through LPL or its affiliates, which are separate entities from,and not affiliates of Seacoast Bank or Seacoast Investment Services. Securities and insurance offered through LPL or its affiliates are:

The LPL Financial registered representatives associated with this website may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.

Topics: Invest & Retirement, Investment Strategies

Are you interested in contacting a local, Florida banker to discuss your individual financial needs? We’d love to speak with you. Schedule a consultation today.

Share: