As we get closer and closer to a new year, financial goals are a common concern. After all, a new year welcomes opportunities to achieve new goals and plan for financial prosperity. Understandably, creating a personal financial plan for your household may feel like a daunting challenge. However, following a few simple steps, it doesn’t need to be. In this article, we’ll share the following:

A financial plan is not a secret algorithm with overly complex structures. It’s simply a

strategic document that helps you outline your current financial state and plan for the future. More importantly, it allows you to compose strategies to maintain your existing wealth or achieve new financial goals. From a granular perspective, the benefits of creating a financial plan include:

Now that you understand what a financial plan is and reasons you should create a personal financial plan for your household, let’s dive into how to create a financial plan for yourself.

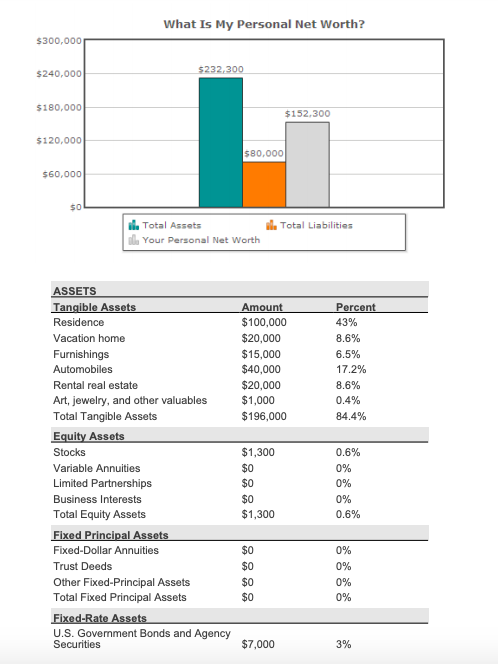

To begin creating a financial plan start by defining your existing financial state. Some common methods used to define your current financial state include financial ratios and financial statements, or personal net worth calculations. For example, CalcXML provides an easy to use personal net worth virtual calculator. The calculator is a simple tabbed form that allows you to enter your financial data like assets, investments, and liabilities. It will then automatically calculate your net worth and yield a report like the one showcased below. The report can be exported as a PDF file as well.

In most cases a personal net worth visualization is sufficient to begin creating your financial plan. However, if your financial situation is more complex than a financial advisor may be the ideal option for you.

Now that you have an understanding of your existing financial state it’s time to define your new financial goals. First, it’s important to have a firm grasp on what a financial goal actually is. Similar to other types of goals in life, financial goals are overarching objectives that define how you want to save and spend your money. For example, when you set a health and wellness goal there is an overarching theme (e.g. I want to lose weight in 2022 or I want to make more money in 2022). In the same respect financial goals have an overarching theme (e.g. I want to save money in 2022). Some common examples of real world financial goals include:

Setting these goals beforehand will help you craft a financial plan where your goals are achievable as opposed to idealistic. In order to ensure your goals are achievable here are some questions you should keep in mind.

It’s important to ask these questions during the goal setting process to ensure your goals align with your future situation. More importantly, when goal setting, we have a tendency to set goals that are unsustainable in the long term. This is the reason so many New Year’s resolutions are forgotten by March. When it comes to financial planning, slow and steady wins the race.

Now that you understand what a financial goal is and how to set one it’s time to consider the cost of achieving that goal. For example, let’s explore the cost of common real world examples recapped below.

If your goal is to pay off debt, first identify the value of your debt. For example, you may want to pay a credit card off completely - a place to start can be by finding a simple credit card debt calculator. Then input the credit card balance, interest rate, and desired pay off months. The calculator will define the cost of your financial goal including principal and interest.

The key takeaway is to specify not only the value of the goal but also other factors that impact reaching that goal. In this example, we considered the principal amount owed plus interest payments. Other examples include: commuting costs for a part-time job or the cost of certification tests and study materials to increase monthly income.

If your goal for the year is to increase your investment portfolio by 20% you should consider the different factors associated with this goal. Some of these factors may include 20% of your current portfolio value, advisory fees, management fees, and transaction fees.

If you goal for the year is to save money for a car you can quantify the coast of the goal by including different components associated with purchasing the vehicle. Some of these components may include the cost of a down payment, vehicle financing, insurance, and registration fees.

In the sections above we discussed how to set goals for your 2022 financial plan and how to determine the cost of your goals. Moving forward let’s explore some adjustments that can be made to help you achieve your goal. Simple adjustments to your budget can increase liquidity so that you can direct money to other areas (e.g. retirement savings, debt reduction, etc.). Some examples of simple adjustments include:

Let’s explore these adjustments in further detail below.

Discretionary spending is spending that is considered non-essential. This means that a household can continue to operate without these expenses. Common discretionary spending adjustments include:

Reducing discretionary spending is an excellent method for finding money and directing it towards a positive goal.

There are many advantages to consolidating debt especially with regard to debt repayment as well as unruly interest rates. Typically, debt consolidation allows you to consolidate your debt into one single monthly payment as opposed to many different payments. For example, you may have multiple loans or credit cards that you pay each month. Each of these loans and credit cards have different interest rates, payment schedules, and amounts. When you consolidate your debt, all of your payments are rolled into a single payment. This often makes it easier to pay off debt faster, reduce interest payments in the process, and oftentimes helps decrease the amount paid monthly. This allows you to have more money to pay towards your debt principal to help you pay off your debt faster or the savings can be directed to help meet another financial goal you may have.

Increasing your income streams may be the method you use to reach your new financial goal(s). Increasing your income streams means finding a method to create another stream of income. For example, you may already have a full-time job. However, during the weekends you may decide to go to yard sales and purchase old items and refurbish them and then sell them on Ebay or Amazon, etc.. Of course you’re not limited to flipping gently used goods as there are many different options to increase income streams:

The key is to be creative with your talents and time while minimizing the cost of the goal. If the intended income stream is not generating actual money than it’s more of a hobby as opposed to an income stream.

Now that you’ve assessed your current financial state, outlined new year goals, identified the cost of those goals, and outlined adjustments that will help you achieve these goals, it’s now time to launch your plan. Putting this plan into action simply requires personal discipline and of course driving those adjustments to the finish line (e.g. applying for a debt consolidation loan or landing a part-time job).

Apart from executing the changes, it’s important to consistently review your plan on a monthly basis to track actual performance. This is important to achieve data integrity and it will also help you compile a more detailed plan for 2022. In short, the more details you have about how you spend and save your money, the better prepared you’ll be to make advantageous decisions in the long run.

Want to learn more about how you can create an optimal financial plan? Speak to an advisor by filling out the form below.

Topics: Financing